GiveDirectly’s Cash for Poverty Relief Program

In a nutshell

GiveDirectly’s Cash for Poverty Relief program involves sending one-off unconditional cash transfers of ~$1,000USD (nominal) via mobile money platforms to households living in poor regions of low-income countries in sub-Saharan Africa. We estimate that this program is ~3-4x more cost-effective than we had previously estimated, and around ~30-40% as cost-effective as our marginal funding opportunity.

We think that the main benefits of the Cash for Poverty Relief program come from consumption gains to households that receive cash transfers. We also think there are benefits to households in nearby villages that don’t receive cash transfers, as increased spending by recipient households stimulates local economic activity. Finally, we think there are health benefits from the program – e.g. reductions in child mortality and morbidity – though we think these are less important than consumption gains that accrue to recipient and nearby non-recipient households.

Our main uncertainties concern: i) the persistence of consumption gains to recipient households; ii) the magnitude of consumption gains to nearby non-recipient households; iii) how much we ought to value increasing consumption vs. averting deaths or improving other health outcomes. All of these assumptions are based on relatively few empirical studies, and we may update them as new evidence comes to light.

|

Cost-effectiveness analysis accompanying this report: Link Note: The figures in this report are from our October 2024 cost-effectiveness analysis, and represent our best guess at that moment in time. At the moment, we have no concrete plans to update this analysis, though we expect new evidence on GiveDirectly’s Cash for Poverty Relief program (and unconditional cash transfers more generally) to emerge over the coming months and years. We may update this analysis in light of this. |

Published: November 2024

Previous version of this page:

- November 2020 report on GiveDirectly

- December 2018 report on spillover effects of GiveDirectly's cash transfer programs

- November 2018 report on cash transfers

Table of Contents

- In a nutshell

- Summary

- 1. The basics of the program

- 2. How GiveWell estimates cost-effectiveness

- 3. How many people are reached?

-

4. What impact does the Cash for Poverty Relief program have?

- 4.1 Summary

- 4.2 Consumption benefits to recipients

- 4.3 Consumption benefits to non-recipients (spillovers)

- 4.4 Mortality benefits to recipients

- 4.5 Additional benefits and downsides

- 4.6 How are donations allocated across countries?

- 5. Additional perspectives beyond our cost-effectiveness model

- 6. Sources

- 7. Appendix

Summary

Basics

GiveDirectly’s Cash for Poverty Relief program involves sending one-off cash transfers of ~$1,000USD (nominal) via mobile money platforms to households living in poor regions of low-income countries in sub-Saharan Africa. These transfers are unconditional: GiveDirectly places no restrictions on what people can spend their money on, and eligibility isn’t conditional on certain behaviors (e.g. sending children to school). Recipients are informed that these transfers are one-off – i.e. that they shouldn’t expect additional transfers from GiveDirectly in the future.

Currently, the program is operational in 5 countries: Kenya, Malawi, Mozambique, Rwanda, and Uganda. In deciding where to distribute transfers, GiveDirectly targets villages they haven’t targeted before in regions with high absolute poverty rates, but also considers neglectedness, government priorities and permissions to operate, and factors related to operational feasibility (e.g. whether there is good cell network coverage). Targeting is universal within villages where they expect >80% of residents live below the extreme poverty line: every household is typically eligible to receive a transfer, provided there is at least one member that permanently resides in the village and is over the age of 18, and nearby villages receive transfers more or less simultaneously. Transfers are sent via mobile money platforms; if households aren’t in possession of a mobile phone, GiveDirectly offers to give them one and then deduct the cost from the transfer amount.

How cost-effective is it?

As of October 2024, our best guess is that donations to GiveDirectly’s Cash for Poverty Relief program are ~3-4x more cost-effective than we had previously estimated, and around ~30-40% as cost-effective as our marginal funding opportunity.1 Our best guess varies from ~3x in Kenya to ~4x in Malawi. Cross-country differences are driven by our estimate that the average recipient is poorer in Malawi vs. Kenya, and our assumption that absolute consumption gains are more welfare-enhancing for poorer households (i.e., that there is diminishing marginal utility of consumption). We may update this estimate in future in light of research that’s currently in progress.

We think that around half the benefits of GiveDirectly’s Cash for Poverty Relief program come from consumption gains in households that receive cash transfers, which have been extensively researched through several randomized trials. Intuitively, a cash transfer enables people to spend more on food, furniture, and productive assets like farm tools. We don’t think there is credible evidence that GiveDirectly’s cash transfers increase the consumption of temptation goods (or ‘bads’) like alcohol or cigarettes.

With GiveDirectly’s current default program design (universal within-village targeting and simultaneous disbursement), we think households in nearby villages that don’t receive transfers are also likely to see consumption gains, as they benefit from a virtuous spending cycle brought about by an increase in local demand. Intuitively, households that receive cash are likely to spend some of it in nearby villages, which puts more money in the pockets of small business owners, who then spend it on other locally produced goods and services. Our estimates of these ‘spillover’ effects are informed by a recent randomized evaluation of GiveDirectly’s Cash for Poverty Relief program in Kenya (Egger et al., 2022), which finds large positive consumption spillovers to non-recipient households. We adjust these results downwards towards a more skeptical prior, which is partly informed by the broader evidence base, and to account for how likely we think these results are to generalize to more saturated program designs in poorer contexts, which we think characterizes the current programmatic context.

We also expect there to be health benefits from the Cash for Poverty Relief program – for example, with more cash in their pocket, recipient households might purchase more food and medicine, or invest in health-related home improvements (e.g. new toilets or floors). We model under 5 child mortality effects based on preliminary results we’ve seen from a randomized controlled trial (RCT) of a Cash for Poverty Relief program in Kenya, which finds a 46% reduction in all-cause under 5 mortality. We make a steep 50% adjustment to this result, but even if we took it at face-value, it doesn’t make a big difference to our overall cost-effectiveness estimates. Intuitively, we don’t think the Cash for Poverty Relief program represents a cost-effective opportunity to save lives because, unlike the programs supported by our Top Charities (e.g. seasonal malaria chemoprevention), the program is expensive per household and isn’t as targeted at medically vulnerable populations.

We quantify these benefits using a cost-effectiveness analysis, which allows us to compare across different programs. Here is a sketch, using Rwanda (our median cross-country estimate) as an example:

| Best guess | Confidence intervals (25th - 75th percentile) | Implied cost-effectiveness | |

| Program reach (more) | |||

|---|---|---|---|

| Donation to Cash for Poverty Relief (nominal USD, arbitrary value) | $1,000,000 | ||

| Transfer size per household (nominal USD) | $1,100 | ||

| Transfers as a % of total cost | 85% | 80 - 90% | 3.0 - 3.4x |

| Total households receiving a transfer | 850 | ||

| Average household size | 4.3 | ||

| Total people directly reached | 3,323 | ||

| Baseline annual consumption per capita (PPP 2017) (more) | $533 | $453 - $613 | 3.6 - 2.9x |

| Transfer size per capita (PPP 2017) | $715 | ||

| % increase in consumption per person in year 1 (more) | 76% | 65 - 88% | 2.9 - 3.5x |

| Year 2-10 consumption gains (as % of year 1 consumption gains) (more) | 134% | 80 - 188% | 2.5 - 3.9x |

| Moral weight assigned to doubling consumption for 1 person for 1 year (more) | 1 | 0.8 - 1.2 | 2.5 - 3.9x |

| Units of value from recipient consumption gains | 5,736 | ||

| Initial cost-effectiveness estimate (x prev estimate) | 1.7 | ||

| Consumption benefits to recipients (units of value) | 5,736 | ||

| Consumption spillovers to non-recipients (units of value) (more) | 3,630 | 338 - 5,673 | 2.2 - 3.8x |

| Mortality benefits (units of value) (more) | 856 | 439 - 1,282 | 3.1 - 3.3x |

| Additional benefits and downsides (units of value) (more) | 818 | ||

| Overall cost-effectiveness estimate (x prev estimate) | 3.3 | 2.0 - 4.1x | |

How could we be wrong?

Our main uncertainties, in rough order of importance, are as follows:

- How big are consumption spillovers to non-recipients?

We think consumption benefits to non-recipient households are likely to be positive, and a sizable fraction (~60-70%) of the consumption benefits to recipient households. This is informed by a recent evaluation of a GiveDirectly lump sum program in Kenya which found large consumption spillovers to non-recipients (Egger et al., 2022). If we took this result at face-value, it would imply that consumption spillovers comprise ~180% of the consumption benefits of recipients, which would shift our cost-effectiveness estimates to ~4-6x. Though we think this paper is high quality, we adjust this result downwards because of: i) large standard errors on the estimates; ii) the paper's inability to observe net exports (which we think is likely think to bias their estimates slightly upwards); iii) the result seeming incongruous with previous spillover estimates of GiveDirectly’s lump sum program; iv) and the results being surprisingly large; larger than what our prior would have been. The adjustments we apply for this are speculative, and we think people could reasonably disagree about how much weight to place on this finding (more)

- How likely are these spillovers to generalize to different contexts?

The Egger et al. paper evaluates a GiveDirectly lump sum program in Western Kenya that employed within-village means-testing, with only households with a thatched roof being eligible for a transfer. To estimate spillovers in current programmatic contexts, a key question is how we expect these results to generalize to more saturated program designs (where everyone in a village is eligible) and in potentially poorer, more remote settings (e.g. rural Malawi). We’d expect spillovers to be slightly smaller in these contexts, though our adjustments for this also speculative (more)

- How persistent are consumption gains to recipients?

Our best guess is that households see a sharp increase in consumption following receipt of transfers, but that these consumption gains fade-out quickly over time. We’ve been sent preliminary 5-7 year follow-up data from the experiment studied in Egger et al. (2022) which shows more persistent consumption gains compared to what’s implied by our assumptions. If we put these preliminary results in at face-value, our cost-effectiveness estimates would change to ~4-6x. At the moment, we aren’t putting a lot of weight on these results because they haven’t been subject to external scrutiny and seem inconsistent with other long-run follow-ups of unconditional cash transfer programs. We may change our mind about this as this result goes through academic peer review (more)

- How much should we value raising consumption vs. saving lives?

Our overall cost-effectiveness estimate of the Cash for Poverty Relief program depends critically on how much we value consumption gains as opposed to saving lives. We convert these outcomes into a consistent unit of value using our ‘moral weights’, which are based on surveys of donors, staff, and beneficiaries in Kenya and Ghana that present hypothetical thought experiments designed to elicit these trade-offs. We think there are significant limitations of using the preferences stated on these surveys, and think people could reasonably disagree about the relative importance of these outcomes (more)

- Are we modeling spillovers consistently across programs?

GiveWell makes relative funding recommendations: we try to identify the best funding opportunities, relative to other options. Because of this, we try to be consistent about how we model different benefit streams across programs. If we think there are positive consumption spillovers from the GiveDirectly program, one outstanding question we have is whether we should also expect positive spillovers from other livelihood programs we’ve looked at, or from health programs that we expect to increase recipients’ consumption. We plan to look into this further after publishing this update.

- How are consumption gains distributed across households?

A key assumption that underpins our cost-effectiveness modeling of livelihoods programs is diminishing marginal utility of consumption. While we think it’s intuitive that given consumption gains are more impactful for poorer households compared to richer households, we feel uncertain about how consumption gains from the Cash for Poverty Relief program are distributed. Our best guess is that long-run consumption gains and spillovers to non-recipient households are likely to flow disproportionately to relatively richer households (e.g. small business owners vs. subsistence farmers), since these households seem better positioned to capture the gains from increased economic activity. However, our adjustments for this are speculative, and we haven’t dived deeply into the household-level data of the GiveDirectly trials (more)

- How poor is the average household in villages GiveDirectly targets?

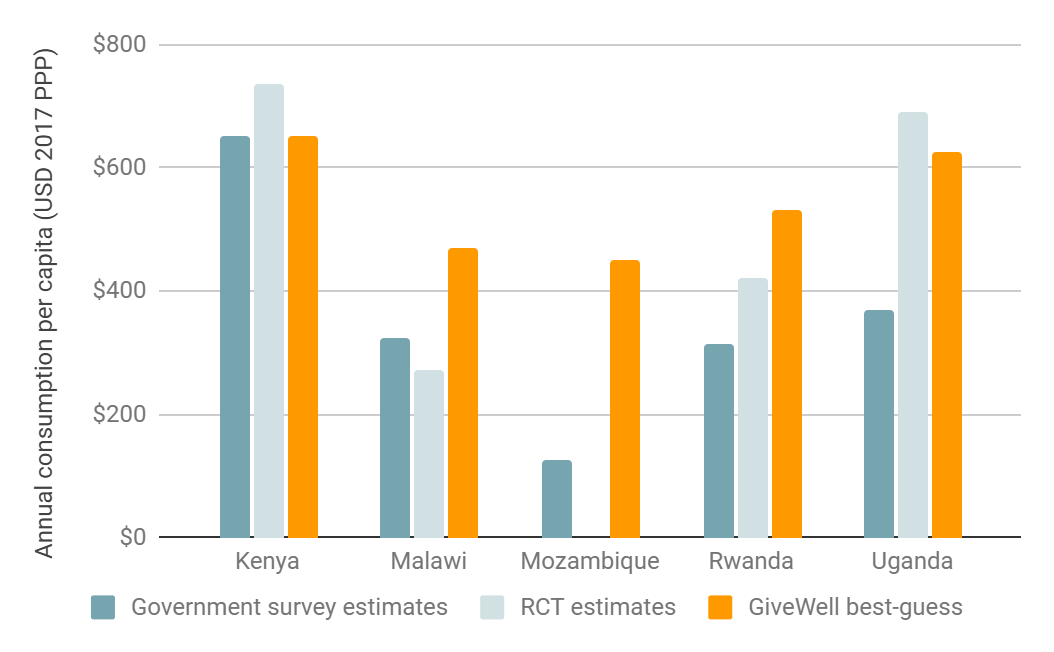

Since we assume diminishing marginal utility of consumption, our model is very sensitive to how poor we think the average recipient household is. Our best guess is that the average household that receives Cash for Poverty Relief transfers is below the international extreme poverty line in each of the 5 countries where GiveDirectly operates, though we expect the average household is meaningfully poorer in Malawi and Mozambique vs. Kenya. Our estimates are based on government consumption surveys and baseline consumption measures of RCTs of the GiveDirectly program, but both these inputs are generally outdated and don’t always agree with each other (more)

1. The basics of the program

1.1 What is GiveDirectly?

GiveDirectly is a US-based not-for-profit focused predominantly on delivering unconditional cash transfers (UCTs) to poor people living in low-income countries. It currently operates 6 program categories:

- Cash for Poverty Relief: transfers an unconditional one-off transfer of ~$1,0002 via mobile money to households living in poor regions of low-income countries (LICs).3 The program is currently operational in 5 sub-Saharan Africa countries4

- Basic Income: transfers monthly unconditional transfers of ~$40 to households living in poor regions of LICs. The program is currently operational in 4 sub-Saharan African countries5

- Emergency Relief: transfers unconditional cash transfers to households recently affected by global crises or natural disasters. The size and location of these transfers depends on the crisis (though is typically between $200-$500).6 Since 2017, GiveDirectly has delivered emergency cash remotely and in-person to 13 countries in Africa, Asia, and North America, across crises ranging from natural disasters to civil conflict7

- Refugees: transfers unconditional cash transfers to recipients registered as refugees in African countries.8 These transfers are typically between $800-$2,000, and can be either lump sum or spread out via monthly transfers9

- Climate Survival: transfers unconditional cash transfers to recipients in non-US countries where GiveDirectly operates. Donations can go towards post-disaster emergency relief or resilience building10

- Cash in the US: transfers unconditional cash transfers to low-income households in the USA. This work is funded by US-restricted and general unrestricted donations11

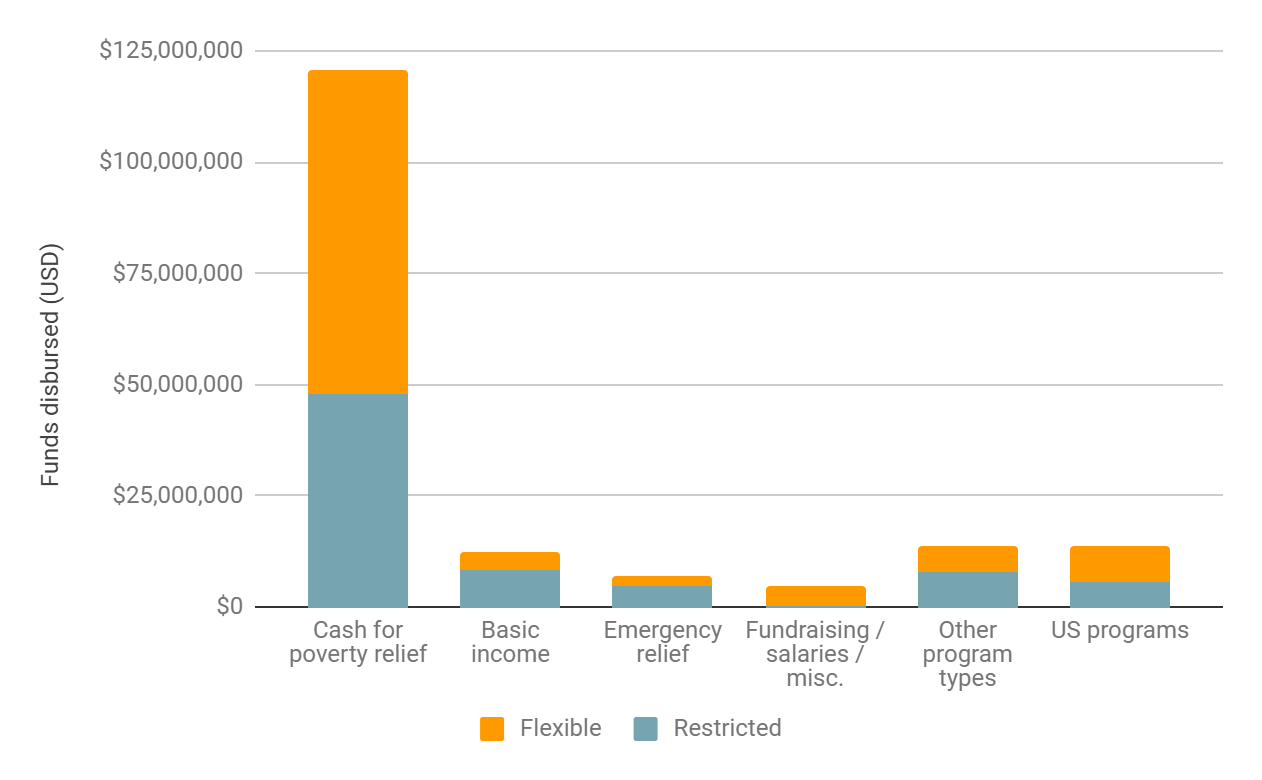

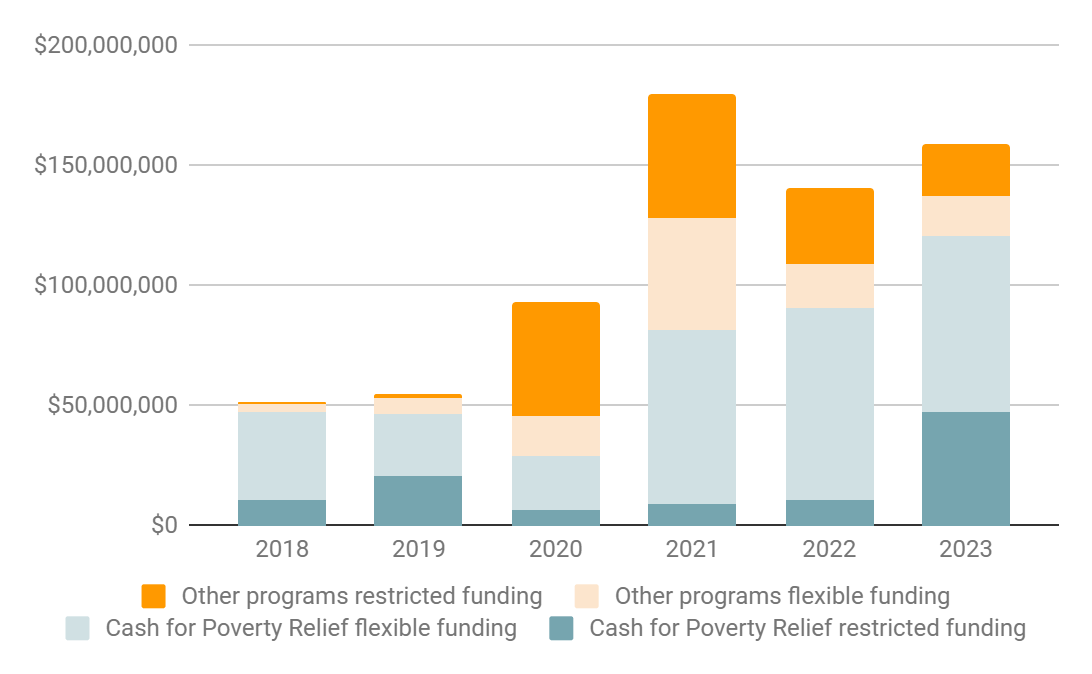

Via their website, GiveDirectly offers donors the opportunity to donate to any cash transfer program in Africa or earmark to one of these 6 program. This report focuses on the marginal impact of donations to GiveDirectly’s Cash for Poverty Relief program, which has historically (and continues to) absorb the majority of GiveDirectly’s funding.12 GiveDirectly’s funding allocations across programs in 2023 are below:

1.2 How does their Cash for Poverty Relief program work?

GiveDirectly’s flagship Cash for Poverty Relief program entails transferring an unconditional one-off lump sum transfer of ~$1,000 (nominal)13 via mobile money to households living in poor regions in 5 sub-Saharan Africa countries: Kenya, Malawi, Mozambique, Rwanda, and Uganda.14 To date, the number of households GiveDirectly has reached with lump sum transfers in these countries ranges from 5,000 – 130,000;15 significantly less than the number of households the World Bank estimates to be living in extreme poverty. This section describes how this program functions.

| Kenya | Malawi | Mozambique | Rwanda | Uganda | |

|---|---|---|---|---|---|

| Population estimate (million) | 54.0 | 20.4 | 33.9 | 14.1 | 47.2 |

| Average rural household size | 4.2 | 4.5 | 4.4 | 4.3 | 4.8 |

| Estimated number of households (million) | 12.9 | 4.5 | 7.7 | 3.3 | 9.8 |

| Poverty headcount rate (%) | 29% | 70% | 75% | 52% | 43% |

| Estimated number of households living in extreme poverty (million) | 3.8 | 3.2 | 5.7 | 1.7 | 4.2 |

| Number of households that have received large one-off GD transfers | 122,997 | 78,579 | 5,485 | 120,393 | 78,929 |

| Max % of households in extreme poverty that could have received a lump-sum GD transfer16 | 3.3% | 2.5% | 0.1% | 7.1% | 1.9% |

How does GiveDirectly decide which countries to work in?

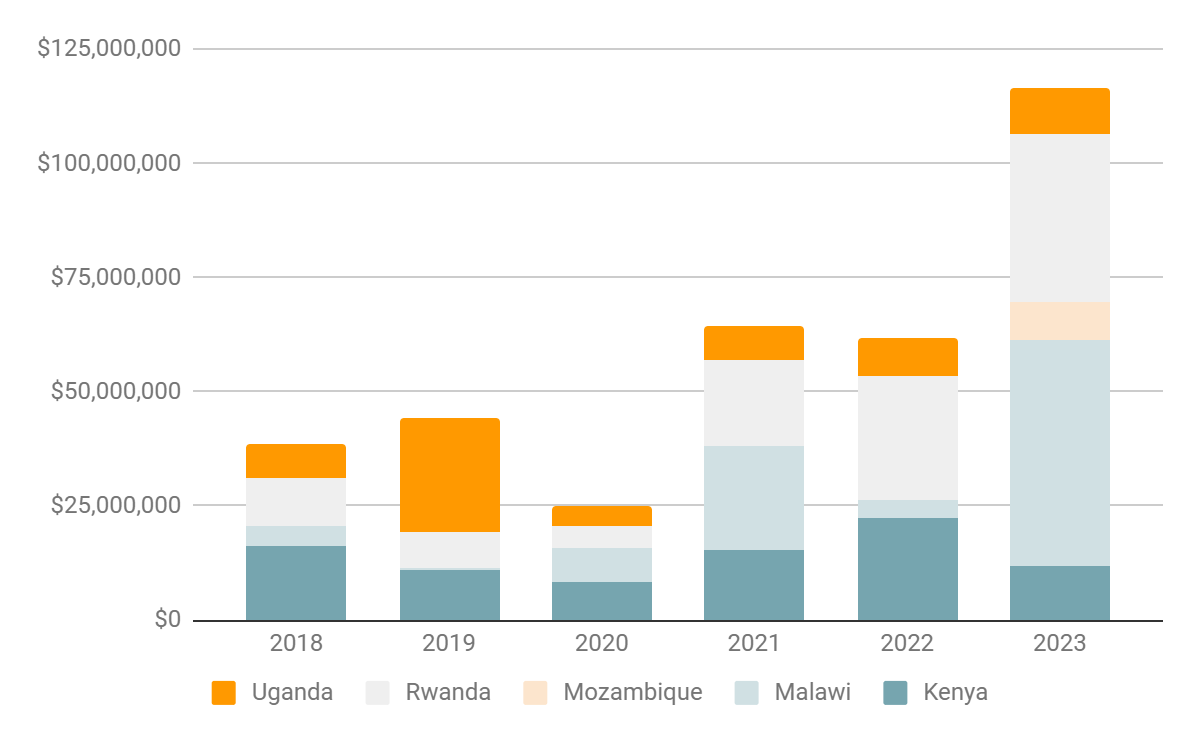

GiveDirectly works in countries which: i) have a high burden of absolute poverty; ii) are feasible to operate in; iii) where they have express permission from the government to operate.17 The Cash for Poverty Relief program has been operational in Kenya since 2011; programming in Uganda, Rwanda, Malawi, and Mozambique began in 2013, 2016, 2019 and 2023, respectively.18 The amount of funding that has been allocated to the Cash for Poverty Relief program across each of these countries since 2018 is shown below.

How does GiveDirectly allocate funding across countries?

When deciding which countries to allocate marginal Cash for Poverty Relief funding to, GiveDirectly considers: i) program efficiency (and whether an expansion of programming could increase efficiency through scale economies); ii) country capacity constraints; and iii) ‘big bets’ – i.e. whether they think giving to a certain country could demonstrate impact or crowd in more funding.19

GiveDirectly uses similar targeting criteria within countries, targeting regions that have high rates of absolute poverty, are feasible to operate in while maintaining efficiency targets, and aren’t already receiving large amounts of aid from the government or other non-government organizations.20

Local poverty rates are usually the most important targeting criterion.21

To rank regions according to poverty rates, GiveDirectly will typically rely on consumption estimates from government surveys, though will occasionally take into account other metrics (e.g. stunting rates) depending on the government's priorities.22

When assessing operational feasibility, one thing GiveDirectly considers is cell network availability, since this is required to receive mobile-money based cash transfers.

How are households enrolled in the program?

Once regions are identified, GiveDirectly staff (known as ‘field officers’) host a community sensitization meeting in each village being targeted.23 The field officer explains what GiveDirectly is, how the program works, and what people need to do if they wish to participate. They also explain that the transfer is unconditional – i.e. people can spend the money on whatever they want – and that it is one-off – i.e. they shouldn’t expect additional transfers in the future.24 At least one member from each household in the village typically participates. Following the sensitization meeting, field officers go door-to-door to cross-check households against residency lists usually given to them by local leaders.25

After a census of households has been taken, registration takes place. All recipients must consent to receive a transfer: since 2020, the average refusal rate has been 0.2% across Cash for Poverty Relief programs.26 Participants also fill out an eligibility survey. Previously, eligibility was determined by living in a house with a thatched roof, which was used as a rough means-test for poverty.27 Since 2017, GiveDirectly has moved towards universal within-village targeting.28 This is now their default design, but occasionally they will layer on some form of needs-based targeting if mandated by the government.29

To be eligible for a transfer, participants have to permanently reside in the village being targeted.30 In Malawi, everyone over the age of 18 is eligible to receive a $550 transfer,31 which means a ~$1,000 transfer for a two-adult household. In Kenya, Mozambique, Rwanda and Uganda, transfers are targeted at households rather than individuals, with each household eligible to receive a transfer of ~$1,000, though the exact amount can vary because of exchange rate fluctuations.32

In theory, individuals or households could be missed due to administrative error, or if no one is available during the multi-day enrollment process.33 GiveDirectly doesn’t specifically collect data on this, though expects this to be very low. The average ‘written-off’ rate is 0.91% for lump sum programs since 202034 – this category includes those that were eligible for transfers but did not receive them, but also those who did receive transfers but were lost during follow-up because they moved location.35

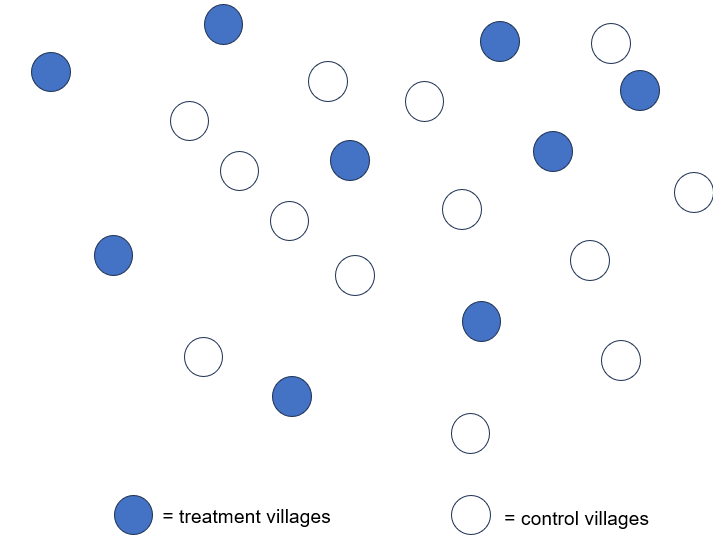

GiveDirectly’s standard process is to register and pay households in nearby eligible villages more or less simultaneously.36

How is the cash disbursed?

All Cash for Poverty Relief transfers are dispersed through a SMS-enabled banking technology called mobile money.37 This requires people to have access to a mobile phone and to a cell network, but internet access is not required. If recipients don’t own a mobile phone, GiveDirectly offers to give them one and deduct the cost from the transfer amount.38 Recipients are required to register with the mobile money platform (e.g. M-PESA) if they don’t have an account; this typically requires a form of formal identification (e.g an ID card or passport).39 GiveDirectly field officers will assist people with this if necessary, and in some cases will coordinate with the government to issue IDs during the enrollment.40

About a month after registration, households are sent the transfer in two parts through mobile money. The total amount disbursed per household is typically ~$1,00041 sent in two chunks – the first ‘token’ transfer is typically 20-30% of the total transfer size, with the remainder being sent a month later.42 Once the money has been received, recipients can withdraw the mobile funds as cash with local agents, who receive commission from the mobile money platforms. GiveDirectly estimates there are 334,000 mobile money agents in Kenya, 145,000 in Rwanda, 472,000 in Uganda, and 24,000 in Mozambique.43

How are disbursements monitored?

After funds are disbursed, GiveDirectly staff call each recipient to verify whether they received the funds and ask questions about their experience of the program. Their internal audit team then follows up with a subset of recipients to identify and investigate potential fraud.44 These are randomized 1:1 follow-ups to check the work of the main enrollment teams, plus targeted investigations if there's a report of a suspected adverse event filed by a recipient or staff member.45 GiveDirectly’s approach to fraud is discussed more in this blog post.

What do recipients spend the money on?

Based on survey data sent to us by GiveDirectly, between 2021 and 2024, the following percentage of recipients of their Cash for Poverty Relief program across Rwanda, Kenya, Liberia, Malawi, Uganda, and Mozambique reported spending some of their cash transfer on the below categories.46

| Category | Percentage of recipients |

|---|---|

| Housing | 63% |

| Food | 62% |

| Household essentials | 46% |

| Livestock | 36% |

| Education | 27% |

| Savings | 24% |

| Agriculture | 16% |

| Business investment | 10% |

| Other | 10% |

| Healthcare | 9% |

We don’t think there’s evidence that recipients use their transfer to buy temptation goods (or ‘bads’) like alcohol and cigarettes. Of the 5 randomized trials of GiveDirectly lump sum transfers that we found, 3 measured effects on temptation goods specifically, and none found that the transfers led to statistically significant or meaningful increases.47 The lack of positive effect is consistent with the more general finding of Evans and Popova (2017), who review 19 studies and find that on average, cash transfers have a negative effect on total expenditures on temptation goods.48

2. How GiveWell estimates cost-effectiveness

GiveWell recommends programs that we believe save or improve lives as much as possible for as little money as possible. To estimate this, we produce a cost-effectiveness analysis (“CEA") which aims to produce a best guess of the overall impact of a program per dollar donated. We use "moral weights" to quantify the benefits of different impacts (e.g., increased consumption vs reduced deaths). These moral weights are based on a combination of staff, donor, and beneficiary stated preferences, and reflect highly subjective value judgments. We benchmark to a value of 1, which we define as the value of doubling someone’s consumption for one year. The main moral weights we use for our analysis of GiveDirectly are in the table below.

| Benefit | Moral weight(units of value per outcome) |

|---|---|

| Doubling consumption for one person for one year | 1 |

| Increasing ln(consumption) by one unit for one person for one year49 | 1.44 |

| Averting the death of a child under five | 116 |

| Other parameters | |

| Discount rate on future consumption gains50 | 4% |

In this report, we estimate separate cost-effectiveness estimates for each country where GiveDirectly’s Cash for Poverty Relief program is currently operating. We also estimate an aggregated cost-effectiveness estimate, which takes a weighted average of these country estimates based on how we expect marginal donations to be allocated across countries. This represents our best-guess of the cost-effectiveness of a donation to the Cash for Poverty Relief program via GiveDirectly’s website. At the time of writing (October 2024), all donations to ‘Poverty Relief - Africa’ are earmarked for the Cash for Poverty Relief program.51

This report and accompanying cost-effectiveness analysis include 25th - 75th percentile confidence intervals for specific parameters. See the summary table above and this sheet of our cost-effectiveness analysis. These intervals are based on GiveWell staff members’ subjective levels of uncertainty for each parameter; we consider them very speculative, though helpful in portraying which parameters we feel most uncertain about.52

3. How many people are reached?

We estimate that each $1m spent by GiveDirectly on Cash for Poverty Relief programming leads to ~740 to ~970 households receiving a lump sum transfer, which directly affects ~3,300 to ~4,100 people. This varies by country depending on the average size of the transfer per household and program efficiency – i.e. the % of each dollar donated that reaches recipients (as opposed to going towards program overheads).

Our calculations are outlined in this spreadsheet and below. Transfer size and program efficiency data are both based on data sent to us by GiveDirectly.

| Kenya | Malawi | Mozambique | Rwanda | Uganda | |

|---|---|---|---|---|---|

| Arbitrary donation (nominal USD) | $1,000,000 | $1,000,000 | $1,000,000 | $1,000,000 | $1,000,000 |

| Transfers as a percentage of total cost | 84% | 84% | 75% | 85% | 71% |

| Total size of transfer per household (nominal USD) | $865 | $1,000 | $1,000 | $1,100 | $955 |

| Number of households receiving transfer | 971 | 840 | 750 | 773 | 743 |

| Average rural household size | 4.2 | 4.5 | 4.4 | 4.3 | 4.8 |

| Number of people directly reached | 4,079 | 3,780 | 3,300 | 3,323 | 3,569 |

4. What impact does the Cash for Poverty Relief program have?

4.1 Summary

Our cost-effectiveness analysis models 3 main benefits from the Cash for Poverty Relief program:

- Consumption benefits to people that receive transfers

- Consumption benefits to nearby people that don’t receive transfers (‘spillovers’)

- Reductions in child and adult mortality

We also include smaller supplementary adjustments to account for additional benefits, such as cash transfers improving the health of those that receive them (morbidity effects), and possible downsides, such as money being misappropriated or lost to fraud.

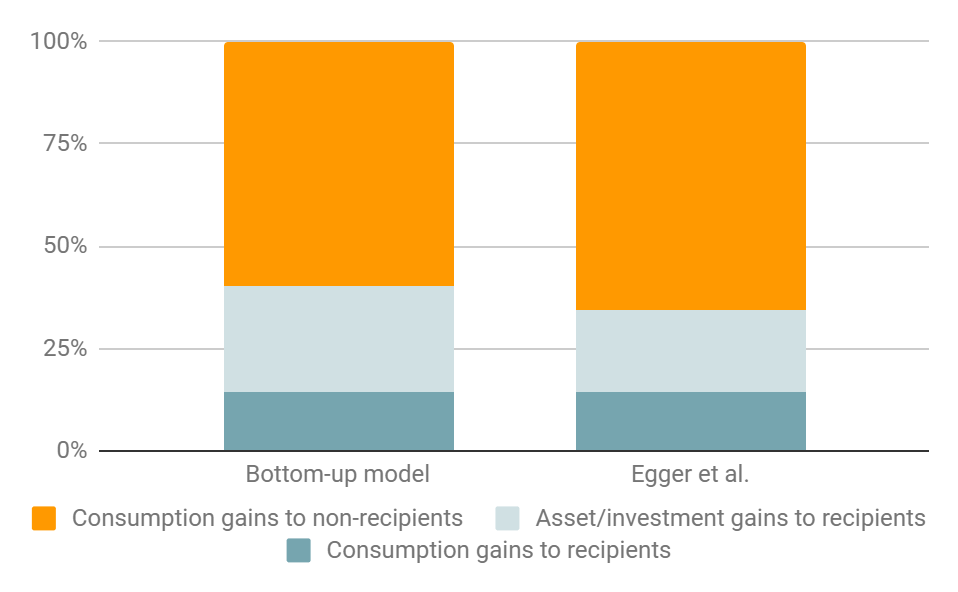

This section walks through how we calculate ‘units of value’ – what we use to measure impact – for each of these benefit streams. A breakdown of each stream's contribution to our overall cost-effectiveness estimates are outlined in this spreadsheet and below. We think the most important benefits from the Cash for Poverty Relief program come from consumption gains of recipient households, followed by spillovers to nearby non-recipient households.

| Kenya | Malawi | Mozambique | Rwanda | Uganda | |

|---|---|---|---|---|---|

| Consumption benefits to recipients | 48% | 53% | 49% | 52% | 49% |

| Consumption benefits to non-recipients | 32% | 31% | 29% | 33% | 31% |

| Child and adult mortality benefits | 12% | 9% | 14% | 8% | 13% |

| Additional benefits and downsides | 7% | 7% | 7% | 7% | 7% |

Across all benefit streams, our key uncertainties are:

- Our estimates of consumption benefits to non-recipients depend on how we expect previous experimental estimates to generalize to current program contexts, and we feel very uncertain about our adjustments (more)

- These estimates also depend on how much weight we choose to place on a particularly influential study (Egger et al.) vs. our prior and the wider evidence base (more)

- Our estimates of the consumption benefits to recipients depend on how persistent we expect these to be. We currently assume consumption gains to recipients fade out across time, but we’ve seen preliminary results from one study potentially at odds with this assumption (more)

4.2 Consumption benefits to recipients

Summary

We expect recipients of Cash for Poverty Relief transfers to see a sharp increase in their consumption in the 12 months immediately following the transfer. We expect consumption gains to last for 10 years – as recipients purchase more food, livestock, and productive assets – though expect consumption gains to fade out quickly after the initial spike. We think these assumptions match the general shape of the evidence base, which shows large but transient consumption gains to recipients following the disbursement of cash (more).

This section of our cost-effectiveness analysis calculates units of value from consumption gains to recipients. A summary is outlined below. The cross-country differences are driven by:

- Differences in baseline consumption across countries (more)

- Program efficiency being higher in some countries vs. others, which allows more households to be reached for a given donation size (more)

| Kenya | Malawi | Mozambique | Rwanda | Uganda | |

|---|---|---|---|---|---|

| Baseline annual consumption per capita (PPP 2017) | $652 | $470 | $450 | $533 | $626 |

| Size of transfer per person (PPP 2017) | $488 | $651 | $639 | $715 | $589 |

| Percentage of transfers consumed in year 1 | 57% | 57% | 57% | 57% | 57% |

| Implied increase in consumption per person in year 1 | $278 | $371 | $364 | $407 | $336 |

| Percentage increase in year 1 consumption over baseline | 43% | 79% | 81% | 70% | 54% |

| Immediate increase in ln(consumption) per person | 0.36 | 0.58 | 0.59 | 0.57 | 0.43 |

| Value assigned to increasing ln(consumption) by one unit for one person for one year | 1.44 | 1.44 | 1.44 | 1.44 | 1.44 |

| Units of value from year 1 consumption gains per person | 0.51 | 0.84 | 0.86 | 0.82 | 0.62 |

| Number of people reached given arbitrary donation | 4,079 | 3,780 | 3,300 | 3,323 | 3,569 |

| Units of value from year 1 consumption gains given program reach | 2,090 | 3,175 | 2,825 | 2,723 | 2,213 |

| Value of year 2-10 consumption returns as % of year 1 consumption returns | 123% | 136% | 140% | 134% | 127% |

| Units of value from year 1-10 recipient consumption gains | 4,663 | 7,496 | 6,772 | 6,374 | 5,019 |

| Distributional adjustment (consumption gains accruing to richer recipients) | 90% | 90% | 90% | 90% | 90% |

| Units of value from year 1-10 consumption gains post adjustments | 4,196 | 6,746 | 6,095 | 5,736 | 4,517 |

Our main uncertainties are:

- How persistent are consumption gains to recipient households? We’ve been sent preliminary (unpublished) results from a 5-7 year follow-up of a randomized evaluation of a GiveDirectly lump sum program in Kenya, which suggests more persistent consumption gains compared to what’s implied by our assumptions (more)

- Do richer households see greater consumption gains from cash transfers? We think there’s evidence of this, but the adjustment we make for it is speculative (more)

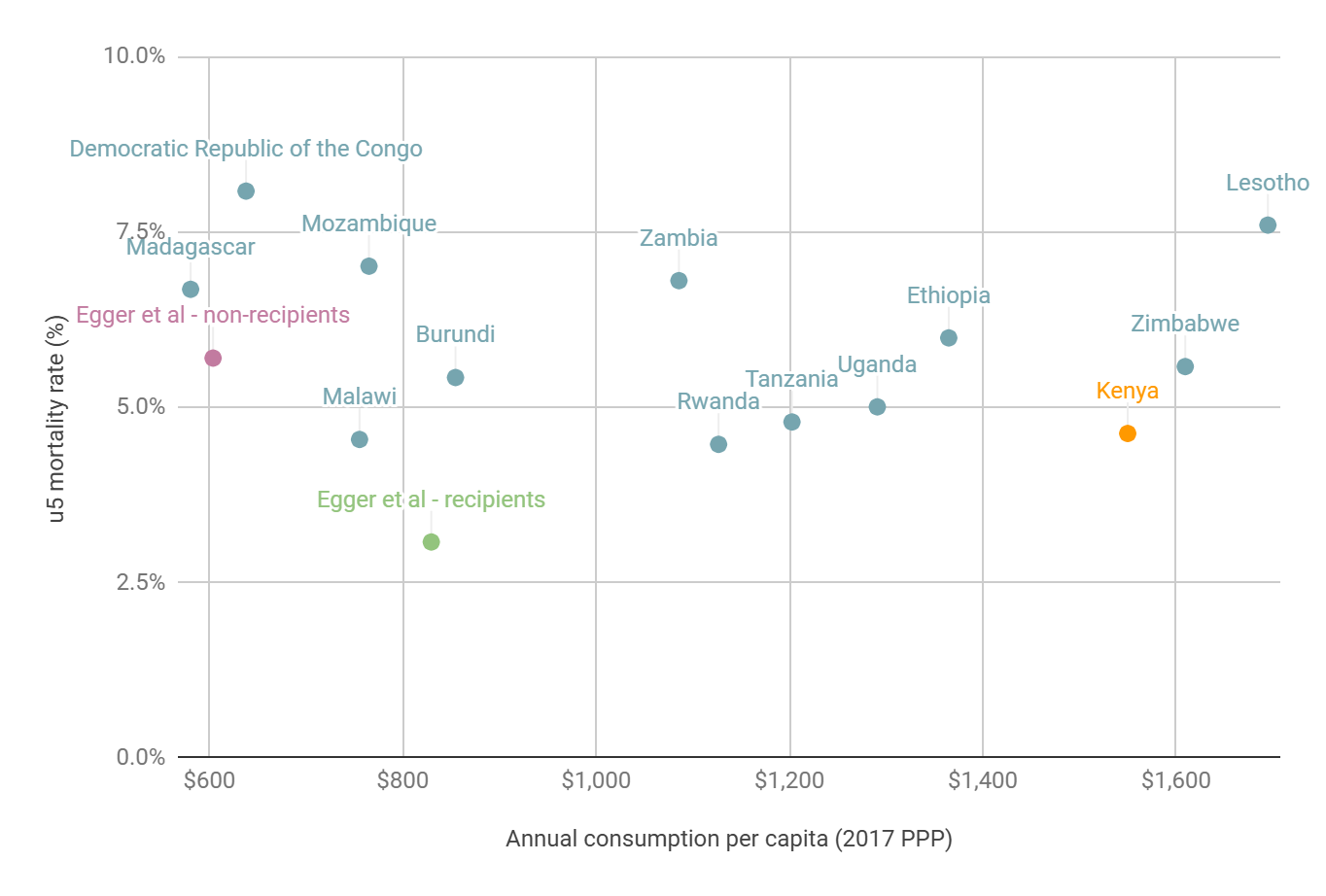

How poor is the average Cash for Poverty Relief recipient?

We value consumption gains relatively: our moral weights assign a value of 1 doubling consumption for one person for one year (more). Concretely, this means we think a $1,000 annual consumption gain for someone consuming $1,000 worth of goods and services a year is more valuable than a $1,000 gain for someone consuming $2,000 worth a year.53

This means it matters how poor we think recipients are before they receive cash transfers.

Our best-guess estimates are presented below. Overall, we think the average Cash for Poverty Relief recipient is likely below the international extreme poverty line54

in each country that the program operates. We expect there to be meaningful variations across countries, with recipients in Malawi and Mozambique being poorer than recipients in Kenya.

| Kenya | Malawi | Mozambique | Rwanda | Uganda | |

|---|---|---|---|---|---|

| GiveWell estimate of annual consumption per capita of GiveDirectly recipients | $652 | $470 | $450 | $533 | $626 |

| Implied consumption per day | $1.79 | $1.29 | $1.23 | $1.46 | $1.71 |

| International extreme poverty line | $2.15 | $2.15 | $2.15 | $2.15 | $2.15 |

| Implied poverty gap (%)55 | 17% | 40% | 43% | 32% | 20% |

Our estimates are based on two inputs: bottom quintile consumption estimates from government consumption surveys and baseline consumption surveys from randomized controlled trials (RCTs) of GiveDirectly’s Cash for Poverty Relief program. We use average consumption of households in the bottom quintile of the overall consumption distribution to proxy Cash for Poverty Relief recipients, since GiveDirectly deliberately targets poor regions in each country.

The step-by-step process we take to convert these inputs into our best guess is described in this section of the Appendix. In this section, we also subject our best guess estimates to basic sense checks, such as comparing them to other international poverty benchmarks and checking whether the relative ordering of countries makes sense, given other cross-country differences in other plausible indicators of material well-being (e.g. stunting rates).

Overall, we feel uncertain about these estimates as both the inputs we use are outdated and don’t perfectly triangulate with each other. We can also think of reasons why bottom quintile consumption estimates from government surveys may not be a perfect proxy for Cash for Poverty Relief recipients – e.g. if operational and efficiency considerations prevent GiveDirectly from targeting the very bottom of the consumption distribution.56 With this being said, we generally feel more confident in these estimates compared to our assumptions about expenditure gains following the receipt of cash transfers. These are discussed below.

How much does a Cash for Poverty Relief transfer increase expenditure?

Summary

We think Cash for Poverty Relief recipients see large gains in consumption immediately after receiving the transfer, as they spend just over half (~60%) of the transfer in the first year. We expect consumption gains to persist for 10 years, but to fade out after this initial spike, as recipients spend down the rest of the transfer and the increase in local economic activity starts to fizzle out.

We think these assumptions seem mostly consistent with the findings of 7 studies (across 5 randomized trials) of the Cash for Poverty Relief program, and studies of other UCT programs. Short-run (<1 year) follow-ups of the program generally find large consumption gains to recipients compared to non-recipient households (Haushofer and Shapiro, 2016; McIntosh and Zeitlin, 2024; Aggarwal et al., 2024). Medium-run (1-3 year) follow-ups of the program also find positive consumption gains, but these seem generally smaller than short-run gains (Egger et al., 2022; Haushofer and Shapiro, 2018; Banerjee et al., 2023). We found no published trials with long-run (3+ year) follow-ups of the Cash for Poverty Relief program, but long-run follow-ups of other UCT programs generally suggest a fade-out in recipient consumption returns over time (Blattman et al., 2016; Blattman et al., 2020).

Our biggest uncertainty stems from preliminary results we’ve been sent from a 5-7 year follow-up of Egger et al. (2022), one of the randomized trials we use to estimate recipient consumption gains. These preliminary results suggest much more persistent recipient consumption gains compared to what’s implied by our assumptions and the broader evidence base. At the moment, we aren’t putting much weight on these results as they’ve not been externally scrutinized, but may update as these results get peer reviewed (more).

What evidence is there on recipient consumption gains?

From a literature review of GiveDirectly’s lump sum transfer program,57 we found 7 studies related to 5 different randomized evaluations. Two of the studies were follow-ups to experiments initially evaluated in other studies. All of these trials evaluated GiveDirectly’s Cash for Poverty Relief Program against a control arm which didn’t receive cash transfers. Trials differed in terms of where they were conducted, program design, the size of the transfers being disbursed, and the timing of endline.

Three of the studies (Egger et al. 2022; Egger et al. (preliminary) and Banerjee et al. 2023) have co-founders of GiveDirectly as listed coauthors.58 We asked GiveDirectly what Paul Niehaus’ involvement was in the Egger et al. paper, and they said other members of the study team took the lead in writing the narrative sections of the paper, and also published a pre-analysis plan before analyzing the data to mitigate risk of biasing results.59 His involvement doesn’t change our interpretation of these papers.

| Paper | Country | Program design | Transfer size per household | Timing of endline | Measures spillovers? |

|---|---|---|---|---|---|

| Haushofer and Shapiro (2016) | Kenya | Within-village means testing | $300-$1,000 ($709 avg) | ~9 months | Yes |

| Haushofer and Shapiro (2018) | ~3 years | Yes | |||

| McIntosh and Zeitlin (2024) | Rwanda | Within-village means testing60 | ~$500 | ~13 months | Yes |

| Aggarwal et al. (2024) | Malawi and Liberia | Universal targeting within villages | $250-$750 | 0-24 months | No |

| Egger et al. (2022) | Kenya | Within-village means testing | $1,000 | ~18 months | Yes |

| Egger et al. (preliminary results) | ~5-7 years | Yes | |||

| Banerjee et al. (2023) | Kenya | Universal targeting within villages | ~$1,00061 | ~2 years | Yes |

To trace expenditure gains across time, we break these papers down by their timing of follow-up:

Short-run (<1 year) expenditure impacts of the Cash for Poverty Relief program

- Haushofer and Shapiro (2016) find that, 9 months after cash was disbursed, recipient households (across both large and small transfer sizes) saw 22% higher monthly expenditure compared to control households62

- McIntosh and Zeitlin (2024) finds that, 13 months after cash was disbursed, household expenditure increases by 30%63

- Aggarwal et al. (2024) collects granular month-by-month expenditure data, which allows them to dynamically trace the spending response across time. They find large initial expenditure gains in Malawi, which fizzle out over the course of 24 months.64 The authors don’t detect a statistically significant expenditure response in Liberia65

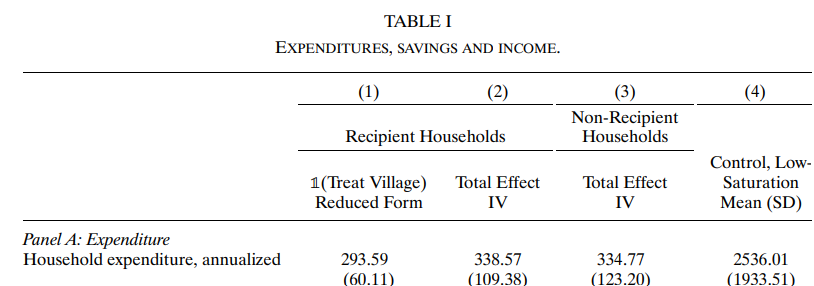

Medium-run (1-3 year) expenditure impacts of the Cash for Poverty Relief program

- Egger et al. (2022) find that, 19 months after cash was disbursed (median timing of follow-up),66 annualized expenditure in recipient households was 13% higher than the expenditure of households in distant control villages67

- Banerjee et al. (2023) study the effects of GiveDirectly’s Universal Basic Income program, but also include a Cash for Poverty Relief arm. Compared to the control group, recipients that received Cash for Poverty Relief transfers saw 6% higher annual consumption ~2 years after the transfers had been disbursed68

- Haushofer and Shapiro (2018) follow-up on the same experiment studied in Haushofer and Shapiro (2016) 3 years later. They find that monthly consumption of recipient households was 9% higher vs. non-recipient households in control villages,69 though this difference is not statistically significant

Long-run (3+ year) expenditure impacts of the Cash for Poverty Relief program

The only long-run consumption estimates of the Poverty Relief program we’ve seen are preliminary results from a 5-7 year follow-up of the same experiment studied in Egger et al. (2022). These results aren’t available online, but were sent to us via email correspondence with the authors (NB: GiveWell funded this follow-up study).70 These initial results imply persistent consumption gains: annualized expenditure in recipient households was 12% higher compared to households in distant control villages – implying almost no fade-out in recipient consumption gains across time.71 At the moment, we don’t place a lot of weight on these results because they’ve not been externally scrutinized; we discuss this more in our key uncertainties section.

Since we lack published long-run evidence on the Cash for Poverty Relief program, we did a brief literature review for long-run follow-ups of lump sum UCT programs more generally. Crosta et al. (2024) conduct a meta-analysis of UCTs in low and middle-income countries, and find suggestive evidence of smaller consumption effects for lump sum (but not ongoing) UCTs in long-run.72 However, their sample is also limited: they only have two data points of lump sum transfers with >3 year follow-ups, both of which evaluated an unconditional lump sum transfer of ~$400 in Uganda (Blattman et al. 2016; Blattman et al. 2020). These papers generally find evidence of a fade-out of consumption gains: in contrast to significant consumption differences found 2 and 4-years post transfers, the 9-year follow-up found that treatment and control groups had converged in consumption (and employment and earning) levels.73

Beyond the papers included in this meta-analysis, we found two other papers from a Google search which seem relevant:

- Fiala et al. (2022) is a working paper that tracks the same Ugandan households studied in Blattman et al. 12 years later, during the COVID-19 pandemic. They find that some positive effects resurface: treated men are significantly more likely to be engaged in an income generating activity, though this does not translate into higher food security. 74 The paper doesn’t measure consumption directly, and finds no effects for women75

- Blattman et al. (2022) look at the impact of an unconditional $300 cash transfer to unemployed youth in Ethiopia.76 After 1 year, recipient earnings were higher than non-recipients, but by year 5, there was almost complete convergence in employment and earnings.77

How we convert consumption gains to units of value

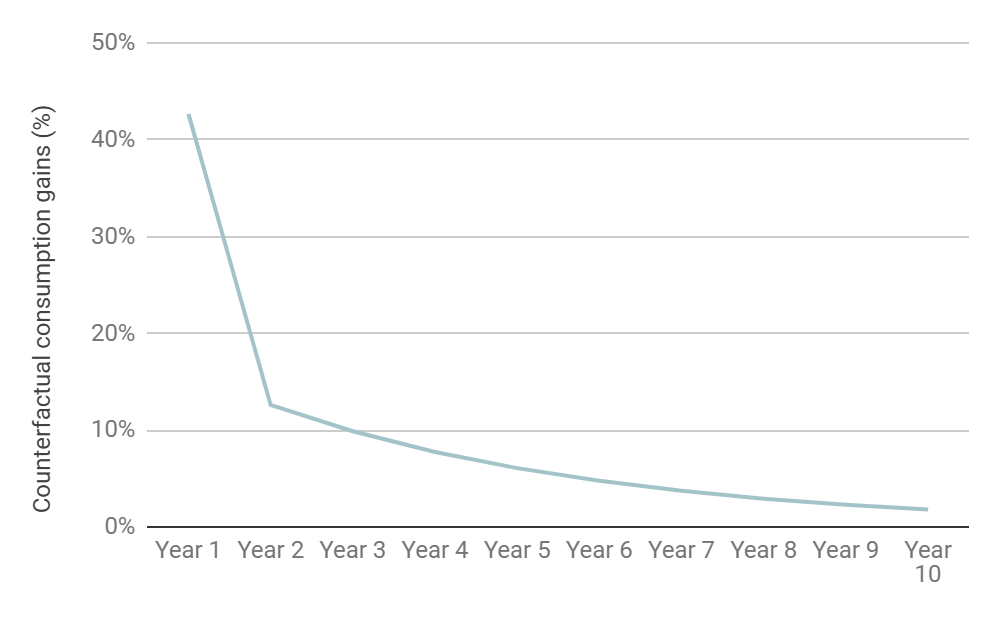

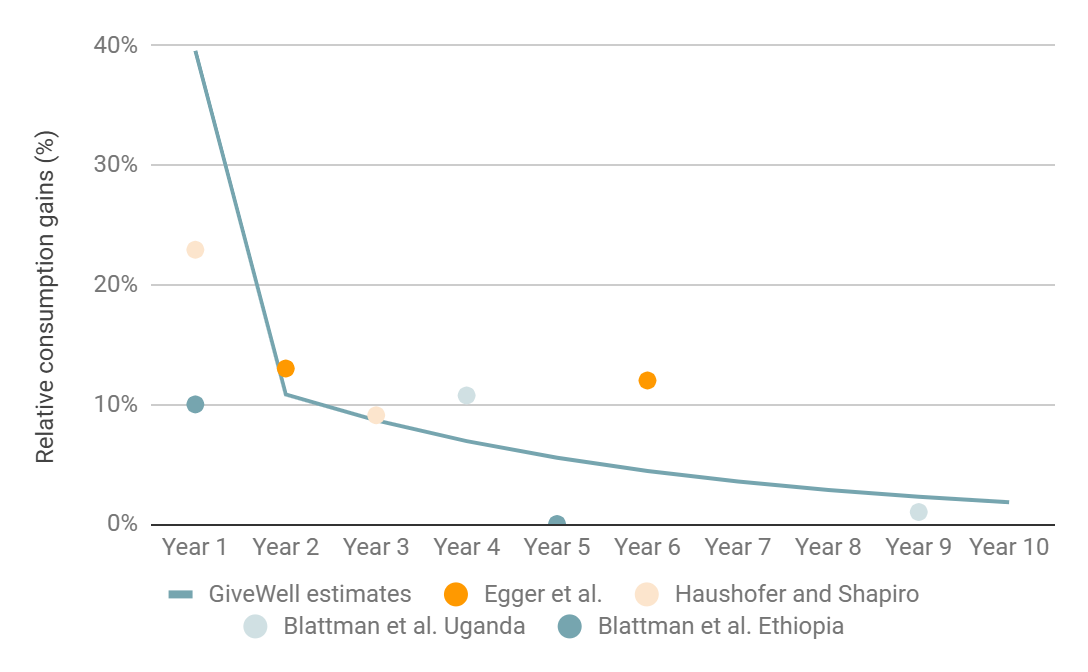

Our overall impression of this evidence is that it points to large initial consumption gains following the receipt of cash transfers, which gradually fade-out across time. To build a cost-effectiveness estimate which fits the shape of this pattern, we make the following assumptions:

- Consumption gains from cash transfers are shared evenly within households – i.e. if household consumption increases by 25%, every member's consumption increases by 25%. We discuss the limitations of this assumption in this section

- Households save or invest78 ~40% in the first year; the remainder of the transfer goes towards immediate household consumption (e.g. spending on food, fuel, durables). This seems consistent with the short-run expenditure patterns documented in Haushofer and Shapiro (2016) and Egger et al. (2022)79

To estimate consumption returns in years 2-10, we make three additional assumptions which we think generates a function that broadly maps to the experimental estimates.80 We assume:

- In year 2, households consume 40% of what was initially saved/invested. This could be through consumption gains realized through spending down transfer savings, or through returns from productive investments (e.g. greater yields through investing in farming equipment)

- In years 2-10, household consumption decays at a rate of -20% a year, leading to a gradual fade-out in consumption gains (e.g. as they spend down the entirety of the transfer or increases in local economic activity start to fizzle out)

- Counterfactually – i.e. in the absence of any cash transfers – consumption of recipient households would have grown by 1-2% per year81

These assumptions generate the following consumption returns profile in Kenya:

To convert these into a cost-effectiveness estimate, we combine these relative consumption gains with our estimates of program reach and our moral weights. To estimate year 1 consumption benefits in Kenya, our calculations are here and summarized below:

| Kenya | |

| Program reach | |

|---|---|

| Arbitrary donation (nominal USD) | $1,000,000 |

| Total size of transfer per household (nominal USD) | $865 |

| Number of households receiving transfer | 971 |

| Average household size | 4.2 |

| Number of people reached | 4,079 |

| Consumption gains to recipients | |

| Baseline annual consumption per capita (PPP 2017) | $652 |

| Total size of transfer per household (PPP 2017) | $2,049 |

| Total size of transfer per individual (PPP 2017) | $488 |

| Percentage of transfer that is invested/saved | 43% |

| Percentage of transfer that is consumed in year 1 | 57% |

| Year 1 consumption gains per person | $278 |

| Increase in ln(consumption) per person in year 1 | 0.36 |

| Value assigned to increasing ln(consumption) by one unit for one person for one year | 1.44 |

| Units of value from year 1 consumption gains per person | 0.51 |

| Units of value from year 1 consumption given program reach | 2,090 |

To estimate consumption gains in years 2-10, we use assumptions 3-5) to estimate likely consumption patterns post-transfers vs. the counterfactual. In Kenya, the implied year 2-10 consumption gains are here and as follows:

| Kenya | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 | Year 8 | Year 9 | Year 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| Counterfactual consumption per capita | $652 | $665 | $678 | $692 | $706 | $720 | $734 | $749 | $764 | $779 |

| Consumption gains | $278 | $84 | $67 | $54 | $43 | $34 | $27 | $22 | $18 | $14 |

| Increase in ln(consumption) | 0.36 | 0.12 | 0.09 | 0.07 | 0.06 | 0.05 | 0.04 | 0.03 | 0.02 | 0.02 |

| Discounted increase in ln(consumption) | 0.36 | 0.11 | 0.09 | 0.07 | 0.05 | 0.04 | 0.03 | 0.02 | 0.02 | 0.01 |

| Discounted units of value | 0.51 | 0.16 | 0.13 | 0.10 | 0.07 | 0.06 | 0.04 | 0.03 | 0.02 | 0.02 |

| Total units of value given people reached | 2,090 | 672 | 513 | 391 | 297 | 226 | 171 | 129 | 98 | 74 |

| Relative consumption gains (%) | 43% | 13% | 10% | 8% | 6% | 5% | 4% | 3% | 2% | 2% |

| Year 2-10 consumption gains (as % of year 1 consumption gains) | 124% | |||||||||

Key uncertainties

Our main uncertainty stems from preliminary results we’ve been sent from a long-run follow-up to Egger et al (2022). These results suggest that, 5-7 years later, recipient households had 12% higher consumption compared to households in distant control villages – almost the same difference as at the 2 year follow-up. If we take these results at face-value, and assume 0% fade-out in consumption gains after year 2, our overall cost-effectiveness estimates change as follows:82

| Kenya | Malawi | Mozambique | Rwanda | Uganda | |

|---|---|---|---|---|---|

| Final CE estimate with best-guess recipient consumption returns | 2.6 | 3.8 | 3.7 | 3.3 | 2.8 |

| Final CE estimate with Egger et al. implied recipient consumption returns | 3.7 | 5.5 | 5.3 | 4.8 | 3.9 |

At the moment, we don’t put much weight on these results because they haven’t been subjected to external scrutiny, and seem generally inconsistent with other experimental findings. However, if these results make it through academic peer review, we would probably update towards them.

If these results survive, two outstanding questions we have are:

- How can we reconcile these results with Aggarwal et. al., Haushofer and Shapiro, and Blattman et al.? While we think there are compelling reasons to think Egger et al. might be better-placed to measure spillovers to non-recipients than Haushofer and Shapiro (more), we don’t think these reasons carry over to consumption gains to recipients,83 so we’d would want to know more about whether this study offers methodological advantages over others

- What are the theoretical mechanisms through which consumption gains could have been sustained? One way to view these results is that these one-off transfers alleviated some kind of ‘poverty trap’, which led to persistent gains. If this is the hypothesis, we’d want to know more about what the poverty trap might have been, and how this story fits with the wider evidence on UCTs, which we think generally finds limited evidence of ‘threshold’ poverty trap models84

Do richer households see larger consumption gains?

Summary

The treatment effects cited in the previous section are average treatment effects, estimated across the entire treated population. Since we value consumption gains more highly for poorer households, we need to take a stance on how we expect these average treatment effects to be distributed across households.

Based on intuition and one experimental study we’re aware of, we think richer households are more likely to see larger consumption gains from cash transfers (in both absolute and relative terms), and hence contribute disproportionately to average effect sizes. We make a 90% adjustment (a -10% downweight) to account for this.

What evidence is there on the distributional effects of cash transfers?

We found one RCT of the Lump Sum Transfer program that looks into this in detail: Haushofer et al. (2022) use the same data as Egger et al. (2022) to look at how recipient consumption gains vary according to baseline assets, which they proxy for material well-being. They find that, ~2 years after transfers, those estimated to be in the bottom 50% most deprived households at baseline had a 20% lower average consumption treatment effect (over the last 12 months) vs. the average, and a 40% lower average consumption treatment effect vs. the richest 50% of households.85

Theoretically, we might expect richer households to see greater returns because they have better investment opportunities, or are better-placed to capture the gains from increased localized spending. For example, a local textiles worker might have better investment opportunities than a subsistence farmer (e.g. purchasing a new sewing machine), and nearby recipients of cash transfers might be more likely to frequent his shop compared to a neighboring farm.

We apply a 90% adjustment to account for recipient cash transfers more likely accruing to richer households. We don’t think a larger adjustment than this is warranted because we expect ~60% of the transfer to fuel immediate consumption increases, and we’d expect this to be pretty evenly distributed given everyone receives the same transfer amount.

Key uncertainties

Our 90% adjustment is speculative – one way we could get a better handle on it is to look at the microdata from Haushofer et al. (2022) to look at the distribution of consumption gains more granularly. We didn’t do this because we didn’t expect it to make a big difference to our adjustment.

4.3 Consumption benefits to non-recipients (spillovers)

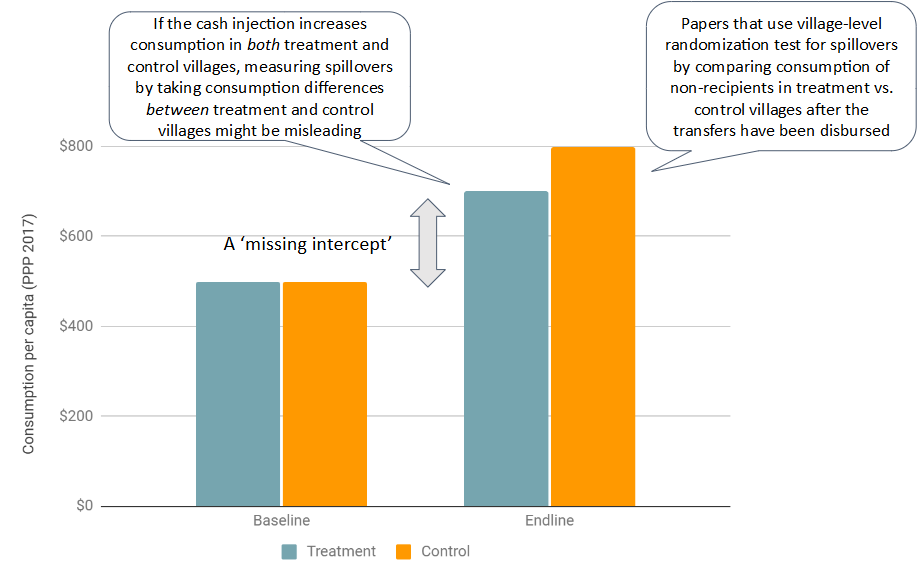

Summary

In theory, GiveDirectly’s cash transfers could affect the behavior and consumption of households that didn’t receive cash. If increased expenditure by recipient households sparks a general increase in economic activity in the region, non-recipient households might also benefit from this. For instance, a local shopkeeper that didn’t receive a transfer could benefit from having more customers come to their shop (a positive spillover). On the other hand, the increase in demand might cause the shopkeeper to raise their prices, which could harm other customers that didn’t receive transfers (a negative spillover).

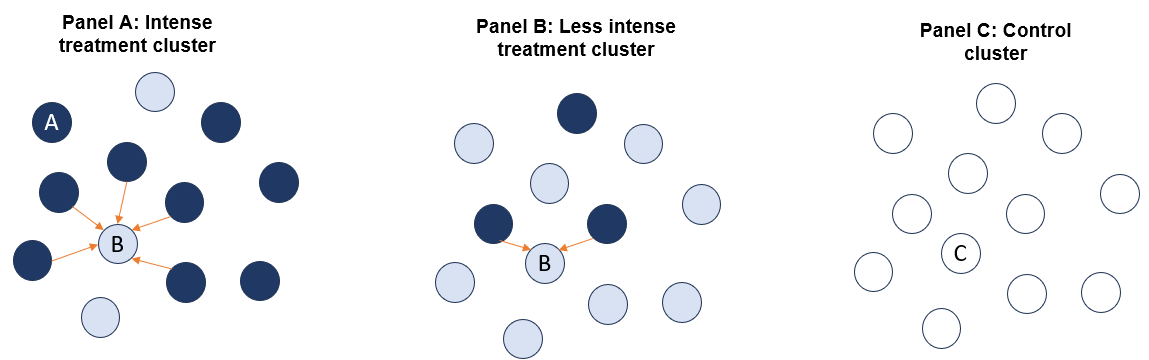

Our best guess is that these general equilibrium effects point in the positive direction, and comprise ~60-70% of the direct consumption benefits to recipient households. This is informed by a recent paper by Egger et al. (2022), which finds large and positive consumption spillovers to non-recipients from a randomized evaluation of a GiveDirectly lump sum program in Kenya. If we took this estimate at face-value, we think it would imply a ~180% adjustment – i.e. almost tripling the direct consumption gains to recipients.

While we think this paper is high-quality, we don’t think we should take this result as-is. First, we don’t think this paper completely supersedes previous papers that have sought to estimate spillovers from lump sum GiveDirectly programs, and generally find much more muted effects. Second, the program evaluated in this study employed within-village means-testing, leading to a less concentrated cash injection vs. GiveDirectly’s current Cash for Poverty Relief program.86 We’d generally expect smaller spillovers under i) more saturated program designs and ii) in poorer/more remote contexts than Western Kenya, so make downwards adjustments to account for this. Finally, we think we ought to account for richer households (e.g. small business owners) being disproportionately likely to capture the benefits of increased economic activity, so make a further downward adjustment.

How these adjustments feed into our bottom-line are outlined here and summarized below. Altogether, we expect consumption spillovers to non-recipients to comprise ~60-70% of the consumption benefits to recipients. This is our best guess of the average effect across all programming sites in each country. We’d expect this average to mask a lot of heterogeneity – with some regions seeing much larger spillover effects than others – given the heterogeneous results of the underlying evidence base.

| Kenya | Malawi | Mozambique | Rwanda | Uganda | |

|---|---|---|---|---|---|

| Units of value from recipient consumption benefits | 4,196 | 6,746 | 6,095 | 5,736 | 4,517 |

| Egger et al. (2022) multiplier estimate | 2.5 | 2.5 | 2.5 | 2.5 | 2.5 |

| Adjustment to remove recipient consumption benefits | 70% | 70% | 70% | 70% | 70% |

| Internal validity adjustment | 60% | 60% | 60% | 60% | 60% |

| External validity adjustment | 80% | 70% | 70% | 75% | 75% |

| Distributional adjustment | 80% | 80% | 80% | 80% | 80% |

| Consumption benefits to non-recipients (as a % of consumption benefits to recipients) | 68% | 59% | 59% | 63% | 63% |

| Units of value from year 1-10 non-recipient spillover benefits | 2,833 | 3,985 | 3,600 | 3,630 | 2,859 |

Our biggest uncertainties are:

- How much weight we should put on the Egger et al. results (vs. previous studies or a more skeptical prior) (more)

- How we should expect this result to generalize to current program contexts (poorer remote regions and more saturated program designs) (more)

- How the gains from increased economic activity brought about by cash transfers are likely to be distributed across households (more)

This second point may be informed by ongoing research in Malawi, which is evaluating the inflationary response from a much more saturated GiveDirectly lump sum program. We expect to have updates in 2025, and may update our best guess in light of these.

What evidence is there of spillover effects to non-recipients of the Cash for Poverty Relief program?

Summary

Of the 7 randomized evaluations we found of GiveDirectly’s lump sum program, 6 try to measure consumption spillovers to non-recipient households. 4 of these papers find null or slightly negative effects, while two (both the Egger et al. papers) find positive spillovers.

The evidence

The headline findings of these papers are summarized below:

- Egger et al. (2022) and preliminary results: ~18 months after transfers were disbursed, this paper finds that nearby non-recipient households had 13% higher consumption compared to distant non-recipient households (who are presumed to be affected by the cash transfers). This increase is similar to recipient households.87 Importantly, the paper also finds minimal (0.1%) price inflation.88 5-7 years later, the preliminary results we’ve been sent suggest non-recipient households still have 8% higher consumption than distant non-recipients, though this difference is not statistically significant89

- Haushofer and Shapiro (2016) and (2018): both the 9 month and 3 year follow-up find evidence of negative consumption spillovers on non-recipients. At 9 months, households which didn’t receive transfers in treated villages had 4% lower consumption than households in control villages, where no one received transfers.90 At 3 years, this difference had widened to 16%91

- McIntosh and Zeitlin (2022):92 finds no statistically significant evidence of spillovers (positive or negative) to households that didn’t receive transfers within villages that did93

- Banerjee et al. (2023): fails to reject a null of no consumption spillovers to non-recipient households in neighboring villages that didn’t receive transfers,94 though doesn’t report point estimates

We don’t place much weight on the preliminary follow-up results of Egger et al. since they’ve not been externally scrutinized. Nonetheless, the published results (Egger et al. 2022) stand in stark contrast to the other papers, which find null or mildly negative spillovers. While this might imply heavy discounts are warranted to Egger et al., we also think this study is generally better-placed to measure spillovers compared to the other studies:

- First, we think it has more credible identifying assumptions than Haushofer and Shapiro, which relies on the assumption of no spillovers across short (~1km) distances to identify unbiased treatment effects.95 For both theoretical and empirical reasons, this seems like a dubious assumption,96 and one we’d expect to bias treatment effects downwards.97 We think Egger et al. (2022) relies on a more credible identifying assumption,98 so think it’s more likely to produce unbiased treatment effects

- Second, Egger et al. is able to leverage a lot more experimental variation – not only do they distribute a large amount of cash,99 they also deliberately vary treatment intensity above the village level,100 unlike Banerjee et al. (2023) and McIntosh and Zeitlin (2024). The authors of both of these papers note that their lack of statistical power means their failure to reject a null of ‘no spillovers’ may not be that meaningful101

Given these advantages, we think Egger et al. serves as a credible top-line to base our spillover estimates on, though we think we ought to make adjustments to it. These adjustments are walked through in the next section.

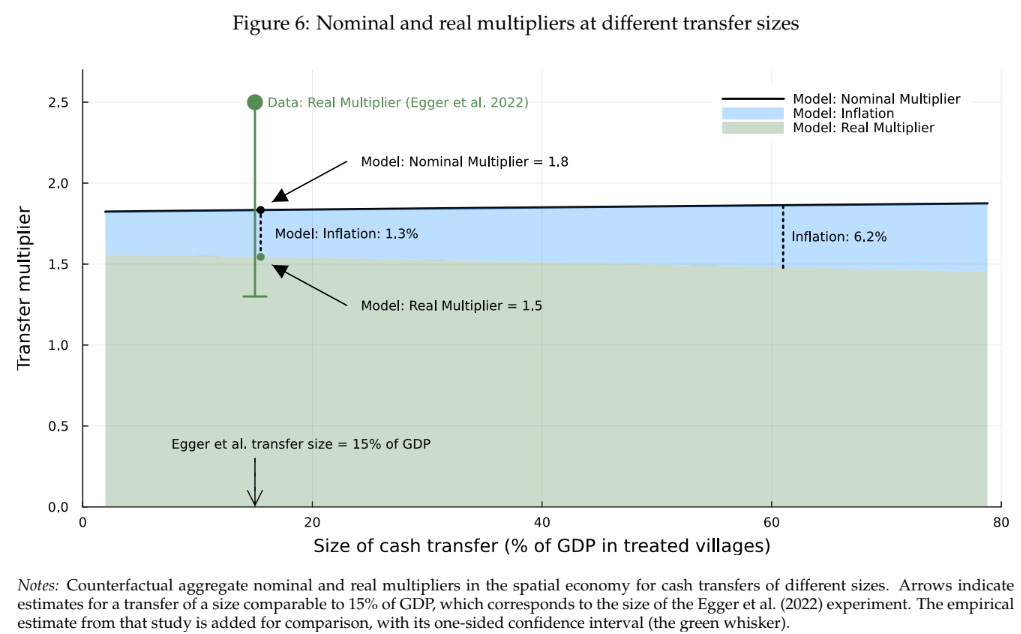

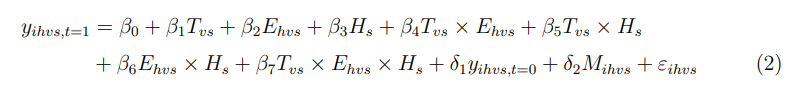

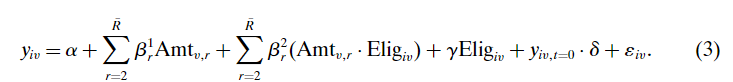

Our approach

To convert the spillover effects to non-recipients in Egger et al. into a cost-effectiveness estimate, we need to take into account the number of non-recipients per recipient treated. Intuitively, if recipients and non-recipients both see a 13% increase in consumption (as Egger et al. find),102 but there are a lot more non-recipients compared to recipients, then the total benefits to non-recipients should outweigh the benefits to recipients.

To account for the relative share of recipients vs. non-recipients in the context that they study, Egger et al. combine their experimental treatment effects with a census taken before the cash transfers took place. They estimate that for every household that received a transfer, around 4 nearby103 non-recipient households were indirectly affected.104 They use this census information to convert their consumption spillover estimates into an economic multiplier,105 which they estimate to be 2.5 at an ~18 month follow-up.106 Intuitively, this means that for every $1 that was injected into the study region, the authors estimate that $2.50 of economic activity was generated. We use this as our top-line to estimate spillover benefits to non-recipients.

Adjustment to strip out recipient consumption benefits

Egger et al. economic multiplier includes both: i) consumption gains to recipients and ii) consumption gains to non-recipients (spillovers). Since we’re capturing consumption gains to recipients elsewhere in our model (as explained here), we should strip these out to avoid double-counting. To do this, we apply a 70% adjustment to the 2.5 multiplier estimate.

To get to this adjustment, we:

- Estimate the increase in economic activity implied by a 2.5 economic multiplier for a given transfer amount

- Estimate how much of this increase is ‘explained’ by recipient consumption gains, based on our assumptions in this section

- Assign the rest of the multiplier to consumption gains to non-recipients

When we do this, we estimate that recipient consumption returns explain ~30% of a 2.5 economic multiplier, implying ~70% of the multiplier comes from non-recipient consumption gains. This is very similar to what Egger et al. estimate themselves.107

| Adjustment to strip out recipient consumption gains | Notes | |

|---|---|---|

| Total transfer amount per person (denominator) | $488 | |

| Transfer multiplier | 2.5 | Egger et al. result |

| Implied economic activity generated (numerator) | $1,220 | Implied |

| Recipient consumption returns by year 2 | $362 | Calculated in this section |

| Implied adjustment | 70% | |

Internal validity adjustment

Summary

We apply internal validity (IV) adjustments to shrink experimental treatment effects towards our prior/what we would intuitively expect. Typically, the size of the adjustment we impose depends on: i) the quality of the estimate (taking into account things like sample size, plausibility of identification strategy, whether the strategy was pre-registered etc.); ii) how credible the theoretical explanation seems; and iii) how the estimate fits with the broader evidence base.

Overall, we apply a 60% IV adjustment to the Egger et al. estimates, which shrinks them 40% of the way towards 0.108 We put a lot of weight on Egger et al. because of the methodological advantages discussed above and some further advantages discussed below. We don’t put all of our weight on Egger et al. because the estimates have large standard errors, and the authors can’t observe imported goods in their study, which we’d expect to slightly bias the estimates upwards. We also don’t think their finding completely supersedes other (more muted) spillover effect estimates, and think their results are surprisingly large compared to our prior.

Reasons we put weight on Egger et al.

We think Egger et al. (2022) is a high-quality experimental estimate – in addition to the advantages discussed above, the study also has many hallmarks of a well-conducted experiment, such as baseline balance,109 low attrition,110 and pre-registered outcomes.111 One thing we find especially compelling is that they have two separate estimates of the economic multiplier – as well as taking a consumption-based approach to measuring economic activity,112 they also take an income-based approach.113 These represent two very standard but independent approaches to measuring economic activity, and the fact that these yield very similar estimates makes us less concerned about possible measurement error.114

Given the importance of this study as our top-line estimate, we funded an external reanalysis of the paper, conducted by Michael Wiebe. The final report is uploaded here. The report finds no major problems with their analysis and the author generally trusts their main results,115 which gives us further reassurance.

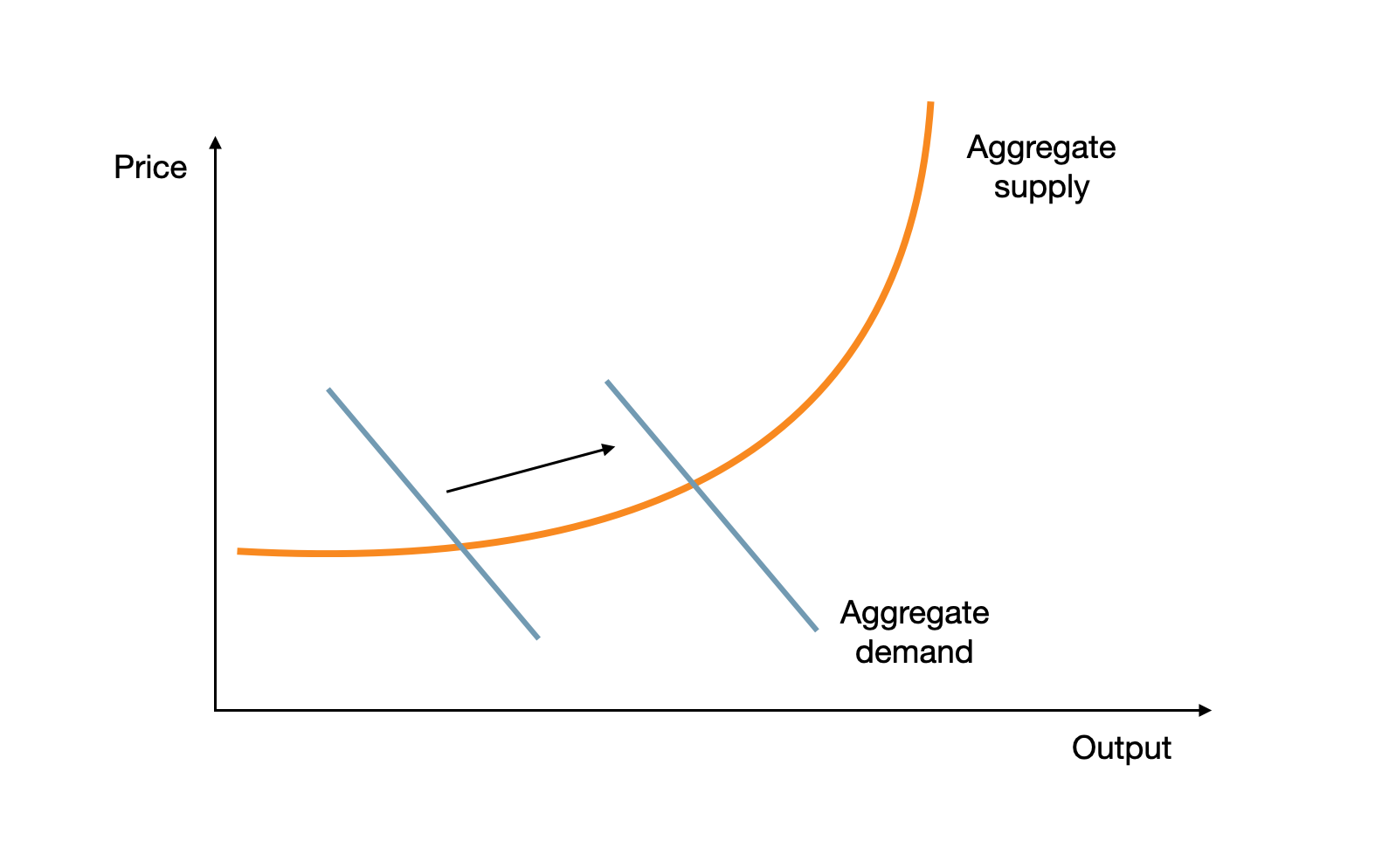

We also think the theoretical explanation the authors put forward to rationalize their findings seems plausible. The authors hypothesize that the large spillovers they observe are due to a demand-led economic expansion,116 facilitated by excess ‘slack’ in the local economy.117 This theory suggests that the cash injection stimulates demand, which businesses can meet without raising prices due to underutilized capacity. This story is spelled out in more detail in this section of the Appendix.

This story seems plausible to us, for two reasons:

- Two of the key building blocks of their story – expenditure multipliers and aggregate demand expansions leading to ‘real’ increases in economic activity – are well-established ideas in economics. While there is a lot of empirical debate about the size of economic multipliers, their theoretical possibility under certain conditions seems quite uncontroversial118

- In a follow-up working paper, Egger et al. run a survey to try and measure the amount of ‘slack’ in the same experimental context. They find convincing evidence of this: from observing shopkeepers in rural Kenya, only 50% of the time was spent on productive activity, and when they asked small businesses how much their costs would increase to expand output by 10%, 40% said zero.119 This lends empirical support for the theoretical mechanism they hypothesize

Reasons we don’t put all our weight on Egger et al.

We don’t think we should put all our weight on Egger et al. for several reasons:

- The multipliers have large standard errors: The expenditure multiplier (2.6) has a standard error of 1.4 and the income multiplier (2.5) has a standard error of 1.7.120 When the authors plot the 95% confidence interval on both multipliers,121 both intervals comfortably contain 1 – which is what we might expect if there were no consumption spillovers to non-recipients. We think we should put less weight on noisier experimental estimates compared to our prior

- The paper doesn’t observe net imports: As the authors note, one limitation of their study is that they can’t observe whether respondents are consuming goods produced inside or outside the study area.122 If imports increase following a cash transfer – as we and Egger et al. would intuitively expect123 – this would bias their multiplier estimates upwards.124 We think would probably make a small difference125 as we expect a lot of consumption is on locally produced goods,126 but it makes us less inclined to fully update towards their result

- The paper can’t observe ambient effects across the study area: by comparing outcomes in households nearby treated villages vs. households in distant control villages, Egger et al. (2022) assumes there were no effects across the study area that affected households in both nearby and distant control villages.127 If ambient effects positively (negatively) affected distant households, this would bias the spillover treatment effects downwards (upwards).128 In a follow-up paper, the authors argue that ambient effects were more likely to be negative, as inflation in distant control villages appears more quantitatively important than income gains.129 Since these net effects are negative, we’d expect the spillover effects estimated in Egger et al. (2022) to be biased upwards, and put less weight on them as a result

- We don’t think it completely supersedes previous studies: While we think Egger et al. has important methodological advantages over previous studies, we don’t think it entirely supersedes them, either.130 Since these generally find much smaller spillovers, this makes us put less weight on the results of Egger et al.

- The multiplier seems surprisingly large: two results we find particularly surprising are: i) consumption gains to non-recipients being twice as large as consumption gains to recipients and ii) their finding of no meaningful price inflation, including for perishable, hard-to-transport products like eggs.131 We find this surprising for both theoretical132 and empirical133 reasons

Taking these considerations into account, our best guess is to apply a 60% internal validity adjustment (i.e. a -40% downweight) to the Egger et al. spillover results.

Key uncertainties

The ultimate adjustment we settle on is highly subjective, and we think reasonable people could place more or less weight on the Egger et al. estimate. We had discussions with several academic experts about this paper – while everyone agreed that this was a high-quality experimental estimate, our impression is that opinions differ on how much this paper updates the message of the wider literature. This is discussed further in this section.

External validity adjustment

Summary

Our external validity adjustments account for how the experimental results we use are likely to generalize to real-world programmatic contexts. In this case, two differences between the context of Egger et al. (2022) and the context of GiveDirectly’s current Cash for Poverty Relief program seem especially salient. First, unlike the experiment studied in Egger et al. – where, on average, roughly 1/3 of households were eligible for a transfer within a targeted village134 – GiveDirectly now does universal within-village targeting, where every household in a targeted village is eligible. Second, while the experiment Egger et al. is conducted in Siaya county in Kenya, GiveDirectly now operates the Cash for Poverty Relief program in other parts of Kenya,135 as well as 4 other countries. As argued in this section of the Appendix, we think Siaya county is likely richer, less agricultural, and less physically remote than more typical contexts of GiveDirectly’s current Cash for Poverty Relief program.

Our best guess is that spillovers to non-recipients are likely to be smaller (but still positive) under more saturated program designs and in poorer and more remote contexts. This is based on some empirical evidence, which finds a greater inflationary response to cash transfers in these settings, and some theoretical arguments, such as labor reallocation frictions making the slack story seem less likely in poorer, more agricultural economies. We apply an 80% external validity adjustment in Kenya (i.e. a -20% downweight) to account for this, and slightly steeper 70-75% adjustments in Malawi/Mozambique/Rwanda/Uganda.

These adjustments bring the Egger et al. results down to the average spillover effects we’d anticipate across programming sites in each of these countries. We’d expect these average effects to mask substantial heterogeneity, with some regions seeing a more pronounced uptick in economic activity and less inflation than others following the disbursement of cash. This seems consistent with two papers discussed below, which find heterogenous general equilibrium effects across different regions in Mexico and Philippines from government-led cash transfer programs.

Reasons to expect similar/larger spillovers in more remote and saturated contexts

One argument for this comes from a recently published working paper by the same authors of Egger et al., (Walker et al., 2024) who try to answer the question of how their experimentally estimated multipliers might generalize to larger cash injections and in poorer/more remote contexts. To do this, they build a spatial general equilibrium model that embeds ‘integer constraints’136 – the idea that you can’t divide a worker or milling machine in half – which is what they hypothesize as a driver of slack in their original paper.137

Two predictions of this theoretical model are especially worth mentioning:

- The model predicts that multipliers will be larger in more remote contexts.138 Intuitively, this is because there is more underutilized capacity (or ‘slack’) in these regions, as high transport costs mean that each mill owner or mechanic (for instance) can only service a very small area of effective demand139

- The model predicts that, under certain conditions (e.g. rural contexts and workers freely moving between the agricultural and non-agricultural sector), real economic multipliers remain fairly constant as the size of the cash injection scales. The authors argue this is because there is so much underutilized capacity in these contexts – e.g. unproductive workers in agriculture – that you can scale up the size of the demand shock by a lot before inflation starts to erode real consumption gains140

One limitation of this model is that it only zooms in on a single mediator of the relationship between the concentration of the program and the real multiplier – integer constraints.141 While the authors argue that this explains more than half of their experimental result,142 it also leaves a sizable fraction unexplained. We don’t have a good intuition about how other frictions proposed by the literature on macroeconomic multipliers (e.g. nominal rigidities or ‘sticky prices’) are likely to scale with the size of transfer.

Reasons to expect smaller spillovers in more remote and saturated contexts

Two reasons we expect smaller spillovers in more remote and saturated contexts are:

- Empirically, two recent papers have found concentrated inflationary effects in remote, saturated regions from government-led cash transfer programs in LMICs. We’d expect inflation to erode real consumption gains

- Theoretically, under certain conditions, Walker et al. (2024)’s model also predicts smaller real multipliers under more saturated program designs. We think these conditions are likely to hold (to some extent) in GiveDirectly’s current programmatic contexts

Empirical evidence on the relationship between inflation and saturation/remoteness

For inflation to erode the value of the real multiplier, we’d have to believe that inflationary pressure increases non-linearly as the size of the cash transfer scales up.143 We don’t have direct empirical evidence on this in the context of the Cash for Poverty Relief program. However, from a brief literature review, two recent experimental estimates from government-led cash transfer programs in Mexico and the Philippines seem relevant:

- Cunha et al. (2019) studies a means-tested government cash transfer program in Mexico, which entailed transfers of $20 per month144 for eligible households.145 They find no detectable price increases on average across the study region.146 However, when they zoom in on the most deprived villages – proxied by physical remoteness and low average income147 – they find that food prices increase.148 We’d expect the relative cash injection to be larger in more deprived villages, given the lower levels of baseline income and higher proportion of households likely to be eligible149

- Filmer et al. (2023) studies a means-tested government cash transfer program in the Philippines, which entailed transfers of $11-32 per household per month150 for eligible households.151 They find minimal price inflation on average, but a large 6-8% increase in the price of perishable products (e.g. fish, eggs) in the most highly saturated and remote villages.152 In these markets, the authors find that this increased child stunting by 11 percentage points153

We don’t think these studies provide conclusive evidence that inflation is likely to erode real multipliers under more saturated versions of GiveDirectly’s Cash for Poverty Relief program. First, the programs studied in these papers are quite different, entailing predictable monthly transfers rather than one-off lump sums.154 Second, what matters for the real multiplier is not inflation per se, but whether inflation scales non-linearly as the cash injection is scaled up,155 and we find this difficult to infer from these studies.